FreeTaxUSA Review 2022: No-Nonsense Tax Software Helps Late Filers Do It For Free

Freetaxusa review 2022 no nonsense tax software helps latex freetaxusa review 2022 no nonsense taxslayer freetaxusa review 2022 no nonsense tax refund freetaxusa review 2022 no nonsense taxisnet freetaxusa review 2022 no nonsense socks freetaxusa review 2022 no nonsense stockings freetaxusa 2022 freetaxusa 2022 coupon code freetaxusa reviews and ratings

FreeTaxUSA Review 2022: No-Nonsense Tax Software Helps Late Filers Do It for Free

This story is part of Taxes 2022, CNET's coverage of the best tax software and everything else you need to get your return filed quickly, accurately and on-time.

FreeTaxUSA may not be one of the big names in tax preparation, but it's been helping taxpayers electronically file their taxes for more than 20 years. There are no bells or whistles, or even graphics, but last-minute tax filers (the federal tax deadline is Monday, April 18) looking for a bargain will be well served by its straightforward approach and bargain price.

FreeTax USA will e-file your federal tax return with unrestricted IRS forms and schedules at no cost at all. A state return will run you $15. An additional, optional $7 will cover a Deluxe add-on that includes live support, amended returns and audit assistance.

Its clean interface, solid support features and efficient question-and-answer process make FreeTaxUSA a good value for a low price tag. Even if you have unemployment income, crypto sales, rental property, retirement distributions, health savings accounts or all of the above, FreeTaxUSA lets you file your taxes for free.

FreeTaxUSA isn't as approachable as tax software from H&R Block or TurboTax, our top pick for best tax software in 2022, nor does it have their options for professional help and support. It's also not completely free like our best free pick Cash App Taxes, but FreeTaxUSA is a thorough, efficient and robust option for filing your federal taxes at no cost.

How does FreeTaxUSA work?

Like most other tax software, FreeTaxUSA starts you off by either importing a PDF of your prior year's tax return or collecting your personal information via the online form. Aside from this, there's no other option to upload files so if you're a freelancer with multiple 1099 forms, you'll have to input the information manually.

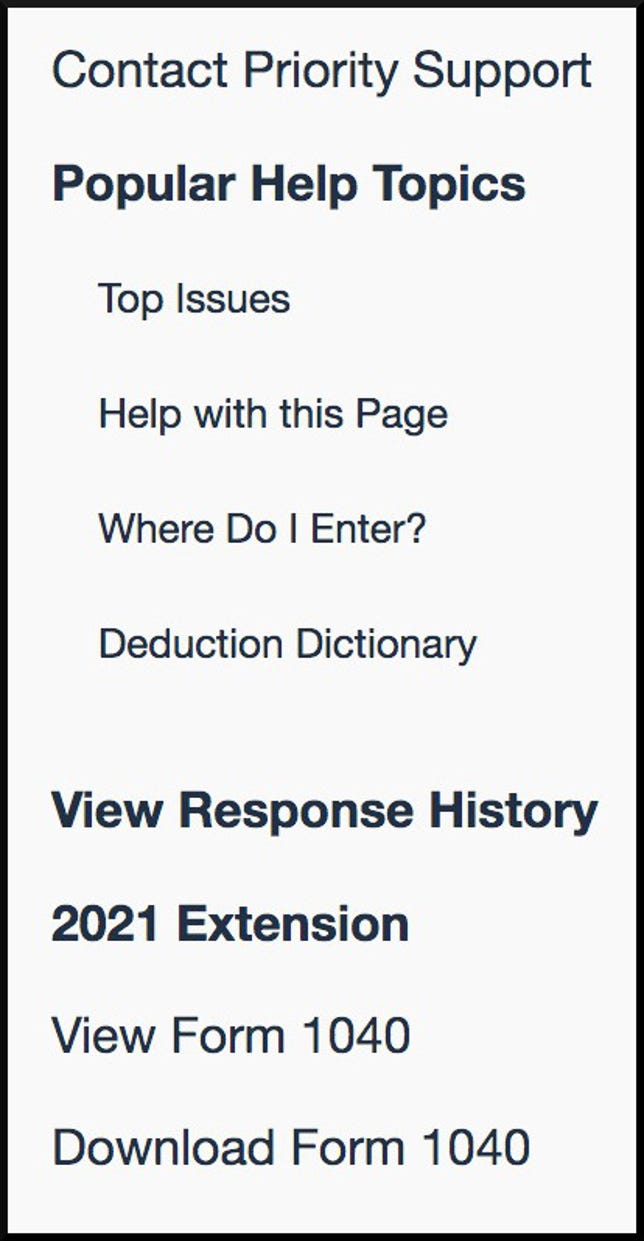

FreeTaxUSA's integrated help features are impressive -- contextual question marks provide valuable, straightforward information in popovers that don't spawn new tabs or browser windows. A useful Help with this page link provides all the support answers related to the particular section of the tax return you're currently completing.

Click Where Do I Enter? for shortcuts to pages where you can enter specific tax details. You can also use the Deduction Dictionary to get specific information on how to claim and where to record 127 different tax deductions and credits.

While FreeTaxUSA provides useful tax information, it lacks the graphical interfaces of higher-priced competitors that simplify the process. For example, FreeTaxUSA explains the differences in tax filing statuses, but instead of making a recommendation, it then leaves it up to you to select your filing status. It does make sure to confirm your filing status during the review of your return, since it's a common mistake in many tax returns.

FreeTaxUSA has cryptocurrency covered, but only seems to allow reporting mining as business income (Schedule C) and not as a hobby (Schedule 1).

ScreeFreeTaxUSA's guided question-and-answer process is well-organized and efficient. The software often marks the most likely answers for some of the less common tax questions so you can easily click through forms without selecting every single Yes or No.

The navigation of FreeTaxUSA splits up into personal info, income, deductions, miscellaneous, summary, state return and filing status. The drop-down menus from each section provide a detailed list of what's included, but you can't jump ahead to many sections until you reach them via the guided process.

After completing each of the income and deductions sections -- the bulk of your tax return -- FreeTaxUSA provides a helpful screen for reviewing all your details and confirming that every item is correct and nothing has been missed.

You can add Deluxe support features at any time -- you don't have to pay the $7 until you file. Upgrading to Deluxe unlocks two new buttons in the support section: "Live Chat" and "New Priority Support Issue." The chat feature is much more rudimentary than TurboTax or H&R block, but I did chat with a representative after waiting 2 to 3 minutes, and he was able to answer simple questions about the software. The live chat feature does not include tax advice, only support for the tax preparation software.

FreeTaxUSA doesn't have any dedicated mobile apps, but the browser-based mobile version works well. Data from my return synced instantly between my mobile device and computer.

What products does FreeTaxUSA offer?

FreeTaxUSA markets its tax software like other products with four levels of service: Basic for simple tax returns; Advanced for itemized deductions; Premium for investment income and property and Self-Employed for freelancers, contractors and gig workers. The big difference with FreeTaxUSA is that all of the plans are completely free.

The plans all run the same software. Once you get into the tax preparation process, there are no more mentions of any of those product levels.

The only paid products that FreeTaxUSA sells are state return filing for $15 a piece and a support add-on called Deluxe for $7. The Deluxe service bumps you to the front of the support line, adds live chat and lets you file unlimited amended returns. Deluxe also includes Audit Assist, which will provide help with both in-person and correspondence audits.

Who should and shouldn't use FreeTaxUSA?

Self-employed filers looking for a cheap way to file their taxes could be well served by FreeTaxUSA. Tax prep plans for gig workers and freelancers are usually the costliest commercial software (top pick TurboTax's Self-Employed plan runs $168 for federal and state, while H&R Block's currently costs $133). While FreeTaxUSA doesn't let you import multiple 1099 forms, you can enter as many as you want, completely free.

FreeTaxUSA lets you view or download your Form 1040 at any point.

Screenshot by Peter Butler/CNETFreeTaxUSA may also appeal to filers who don't mind reading a lot. The interview questions are well organized and the help content is comprehensive, but there are no graphical or design elements to break up long sections of words.

Tax filers who received long-term care or death benefits, usually from an insurance company or the government, also should consider FreeTaxUSA -- it includes support for Form 1099-LTC, which isn't available in similar free tax software.

If you earned significant money in other countries, FreeTaxUSA includes Form 1116 for claiming the foreign tax credit, another form not usually included in free tax software. But keep in mind that FreeTaxUSA does not allow foreign employment income.

Other rare tax situations not covered by FreeTaxUSA include nonresident alien returns (Form 1040NR), at-risk limitations (Form 6198), casualty or theft gain or loss from a business or donations of property over $5,000.

Other notable FreeTaxUSA features

FreeTaxUSA keeps an old-school bookmark tag on every page of the tax return process, letting you mark specific sections or pages to complete or review later. I like the feature in general, but it wasn't ideal for me.

For example, I bookmarked the page for entering the total amount of my advance child tax credit payments in 2021, but when I tried to return to it later, FreeTaxUSA took me to the starting page for dependents. I had to click through a few pages until I eventually found my child tax credit payment details but couldn't go there directly.

FreeTaxUSA displays a running total of your expected refund, which is similar to other software. But it uniquely includes a link to your 1040 form as you complete your taxes, letting you easily preview or download the form as it currently stands.

FreeTaxUSA lets you pay your filing fees (if you have any) by taking money from your tax refund, but there is a $20 charge. FreeTaxUSA does not offer any refund advance loan opportunities. You can receive your refund with FreeTaxUSA by direct deposit, check in the mail or transfer to a prepaid debit card.

A maximum refund guarantee promises a refund and a coupon for an amended tax return if any other tax filing method results in a larger refund. An accuracy guarantee ensures that FreeTaxUSA will reimburse you for any penalties or interest that result from any miscalculation in the software.

FreeTaxUSA also offers a Refund Maximizer feature that reviews your existing deductions and forms and asks additional questions that might increase your refunds. It includes a helpful checklist of IRS forms you may have missed, but the feature overall is not as slick or as integrated as TaxAct's similar Deduction Maximizer feature.

Summary

FreeTaxUSA's comprehensive tax software will help almost any taxpayer file their taxes at no cost. It doesn't provide the sort of hand-holding and expert support that top tax software does, but it includes well-organized and contextual tax help that provides many answers to common tax questions.

The support features of FreeTaxUSA pale in comparison to more expensive products, but their relative cost is far less. While tax filers will still need to run through the gauntlet of usual tax questions, FreeTaxUSA's clean, stripped down process lets them get the job done quickly and efficiently. Its unrestricted offerings for all tax filers at no cost make it worthy of consideration by anyone looking to file their taxes on the cheap.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Source