Google Brings Nest Into The Game As Its AI Battles Alexa

Google brings nest into the game as its airlines google brings nest into the game assassin google brings nest into the game assembly google brings nest into the game as stan google brings nest into the game as big google brings nest into the game asylum google nest app google nest hub max

Google brings Nest into the game as its AI battles Alexa

Google is bringing gadget maker Nest back under its control as the search giant battles rivals Amazon and Apple in the rapidly expanding smart home market. A big part of the change: Making it easier to add Google's artificial intelligence technology and Assistant -- a digital helper that competes against Amazon's Alexa and Apple's Siri -- into new Nest products.

The world's largest search engine has staked its future on building Google smarts into devices beyond smartphones. On Wednesday, Google said Nest was part of its plans and would no longer operate as a separate division that lived in the outer orbit of parent company Alphabet's "Other Bets" group of projects.

Instead, Nest rejoins the Google mothership -- the part of Alphabet that houses search, YouTube, Android mobile software and other moneymakers. Nest, acquired by Google in 2014, had been operating outside of Google, the only profitable division of Alphabet, for the past three years.

Under the new org structure, Nest CEO Marwan Fawaz reports to Google's hardware chief, Rick Osterloh, a former Motorola executive who took charge of all Google's consumer devices in 2016. That includes Google Home smart speakers, Pixel smartphones and Chromecast streaming devices.

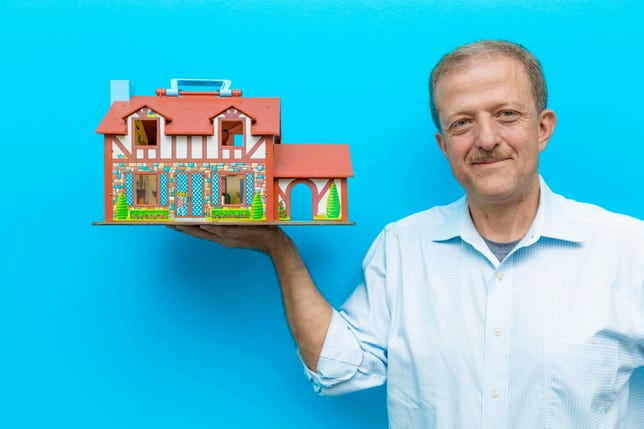

Nest CEO Marwan Fawaz says the company has shipped 11 million products to date.

James Martin/CNET"All of Google's investments in machine learning and AI, they can very clearly benefit Nest products. It just makes sense to be developing them together," Osterloh said in an interview Tuesday, which included Fawaz and took place in a meeting room designed to look like a home, complete with a kitchen and a washer-dryer setup. "It's the natural thing to evolve to."

Nest's brand, known for its 2011 internet-connected thermostat, isn't going anywhere, Osterloh and Fawaz said. In fact, the two drilled home the message that the reunion of the teams will "supercharge Nest's mission," as Fawaz put it. They used the word "supercharge" at least five times during our 40-minute interview at Nest headquarters in Palo Alto, California.

Fawaz said Nest has shipped more than 11 million products since its first thermostat went on sale in 2011. Since it's been part of "Other Bets," Alphabet doesn't call out how much money Nest makes or loses.

The biggest change: Making Google's AI technology a staple in future Nest products. I asked if that means making every new Nest device an access point for the Google Assistant. That integration is "core to the strategy," said Fawaz, but nothing is set in stone. Nest has already begun building the Assistant into devices like its Nest Cam IQ indoor camera.

Nest and Google have already plotted out and finalized their hardware roadmaps for 2018, but in the next two years, they'll start co-developing products. Google also plans to offer more bundled packages for Nest and Google devices, like one deal last year that paired Nest products over $100 with a free Google Home Mini. Fawaz said people could also eventually use their Google accounts with their Nest app.

One thing that isn't changing: Nest, which won't say how many employees it has, will keep its offices in Palo Alto, instead of moving to the Googleplex in nearby Mountain View.

The decision to merge Nest with Google comes as tech's biggest companies work to infuse their software into every aspect of people's lives, from their cars to homes. People will spend $1 trillion on the so-called "internet of things" by 2020, according to Gartner. And they'll spend over $50 billion on smart home tech in 2022 -- up from $31 billion this year -- according to Statista.

But right now the gateway drug is smart speakers. Amazon dominates that world with its Echo devices, owning 69 percent of the market. Google is far behind with 31 percent, according to a report by Consumer Intelligence Research Partners. Apple, meanwhile, officially enters the market when its new HomePod speaker goes on sale Feb. 9.

Nest was previously a semi-independent unit of Alphabet, Google's parent company.

CNETNest's reunion with Google isn't a complete surprise. In November, The Wall Street Journal reported that Google was considering bringing Nest back into the fold. Osterloh and Fawaz said the merger has been in the works for the last few months. Since the two groups already partner on supply chain operations, packaging and event launches, it made sense for them to be one unit, they said.

Being under the same org chart also makes it easier for Nest to use Google's AI technology, the foundation for its Assistant and the key to new products like its Google Lens and Google Photos services.

"We've leveraged AI capabilities from Google in the past, especially in the computer vision space and facial recognition," Fawaz said. "Being part of the Google family, we get closer to that."

'The whole world is shifting'

A lot has changed since Google bought Nest for $3 billion nearly four years ago. That same year, Amazon introduced its Echo smart speaker, a surprise hit and a big slap to Google and Apple, which were already working on voice search. Google followed in 2016 with Home, a smart speaker that promised to put Google's leading search engine a few voice commands away. And this week, reviews went up for Apple's HomePod, a $350 Siri-enabled smart speaker that Apple touts as having better audio quality than its rivals.

Google has bulked up its hardware efforts in other areas too. Osterloh, former president of Motorola, was tapped two years ago by Google CEO Sundar Pichai to create a new consumer device effort. Though Google has always dabbled in hardware -- think the Nexus Q media player or Chromebook laptops -- Pichai wanted to prove the company was all-in this time around. Under Osterloh, Google unveiled its first branded phone, the Pixel, in October 2016 to rival Apple's iPhone and Samsung's Galaxy. It also added a virtual reality headset, a Wi-Fi router and new Chromecast video and audio streamers to its "Made by Google" product lineup.

Maybe the biggest sign that Google no longer considers hardware a hobby is its $1 billion investment in smartphone manufacturer HTC, which brings to Google over 2,000 HTC engineers -- many of whom already worked on the Pixel phone. The deal officially closed last week.

Google also put on a show last month in Las Vegas at CES, the world's largest consumer electronics conference. In past years, Google has typically laid low while its manufacturing partners, including Samsung and LG, made all the noise. But this year, the company set up a massive stage to showcase its gadgets and plastered the words "Hey Google" -- one of the trigger phrases for the Google Assistant -- over the Las Vegas Monorail. White-suited Google workers greeted showgoers in booths across the conference floor with the sole aim of telling them about how Google Assistant worked with various gadgets, from TVs to headphones.

Nest will be joining Google's hardware division, led by former Motorola executive Rick Osterloh.

James Martin/CNETMeanwhile, after a two-year slump in which it didn't enter new product categories, Nest in September added devices and services, including the Nest Hello smart doorbell and the Nest Secure alarm system.

"It's just a logical move," said Bob O'Donnell, an analyst with Technalysis. "The whole world is shifting. Amazon did a good job of recognizing an opportunity. Others are recognizing it and adjusting accordingly."

Hey, Alexa

When it comes to their smart home rivalry, Google and Amazon haven't been afraid to play hardball -- sometimes at the expense of customers.

Amazon, the world's largest online retailer, doesn't sell Google Home. Instead, searching for that product on Amazon brings results for other products, including the e-commerce giant's rival Echo speaker. Amazon sells some Nest products, like the smart thermostat and smoke detector, but not others, such as the Nest E, a cheaper $170 version of its thermostat, or the Nest Secure alarm system. Also, after banning sales of Google's Chromecast streamers two years ago, in December Amazon agreed to bring them back.

Google, meanwhile, cut off YouTube from working on Amazon's Echo Show video device and Fire TV. And at CES, Google tapped partners including Sony to introduce four new video devices with the Assistant built-in to compete with the Echo Show.

Google has made big investments in hardware with its Google Home line of products.

CNETGoogle, Amazon and Apple know getting adoption for their voice assistants is the key to future riches. Over 5 billion devices that support digital assistants, including Alexa and Google Assistant, will be in use by consumers in 2018, according to IHS Markit, with nearly 3 billion more added by 2021. Of those devices, 39 million will be smart speakers, up from about 27 million units sold in 2017.

That all raises the question: Will Nest's closer relationship with Google mean Nest products stop working with Amazon Alexa?

"This announcement doesn't change that," Fawaz said. "If there are any changes in the future, we'll certainly make sure it's the right decision for consumers."

I pressed them again about the potential for this new arrangement to change the relationship with Amazon.

"I would call Amazon and ask them," Osterloh said. "We don't know. We want to work with Amazon in an open, transparent, symmetrical way. Hopefully they want to do the same. We're continuing discussions with them on that."

(We're checking with Amazon and will update this story when we get a response.)

A rocky tenure

When Nest appeared in 2011, it was a novel enterprise from a leader with a storied pedigree. Nest co-founder and former CEO Tony Fadell became known as the Godfather of the iPod after he played a key role, with Steve Jobs, in developing the seminal music player. Following Fadell's departure from Apple in 2010, he and Nest co-founder Matt Rogers focused on reinventing another market. The answer: a smart remake of home thermostats. The idea was to create a whole suite of forgotten household products that had been reimagined for the internet era. The startup announced its second product, the Nest Protect smoke detector, in 2013.

In 2014, Google bought Nest. That was, in part, to inject the search giant with some of the product magic Fadell brought with him from Apple. But Nest's tenure at Google has been rocky. There was public drama after Nest paid $555 million for Dropcam, maker of the security camera it eventually turned into the Nest Cam. After the buyout, Dropcam CEO Greg Duffy left the company and has since called the acquisition a "mistake." Under Nest, more than 50 Dropcam employees resigned. Duffy has said Dropcam's product roadmap was derailed.

When Google created Alphabet in August 2015, Nest became its own division, alongside other units including Google, the moonshot factory X and health tech company Verily.

It was Nest, though, with its own brand, team and offices, that was supposed to be the model for how the new Alphabet structure would work. But instead of becoming the Platonic ideal for an Alphabet company, Nest underwent more scrutiny. Meanwhile, Alphabet CFO Ruth Porat tightened spending at the "Other Bets."

Fadell stepped down in 2016, and Fawaz, who had worked at Motorola with Osterloh, took his place. (Google briefly owned Motorola before selling it off to Lenovo for $3 billion in 2014.)

Today, all Fawaz will say about Nest's past is that the stories were "a bit exaggerated."

As for the way Alphabet is set up, Fawaz defended it. "Each bet is different. We have different journeys," he said. "In this particular case, Rick and I came together and said, '[Nest rejoining Google] makes sense.'"

"Other bets will have different journeys. They can have a different outcome," Fawaz added. "There's not one size that fits all in the model."

CNET Magazine: Check out a sample of the stories in CNET's newsstand edition.

The Smartest Stuff: Innovators are thinking up new ways to make you, and the things around you, smarter.

Source